Modified Internal Rate of Return (MIRR)

Published on Tuesday, August 9th, 2022 06:11:28 PM

Internal Rate of Return (IRR) Explained

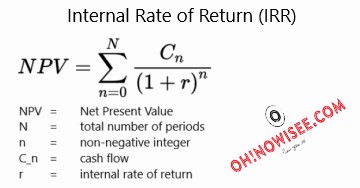

What is the Internal Rate of Return (IRR)?

Internal Rate of Return (IRR) is the rate of return at which the present value of cash inflows from a particular project equals the present value of all cash outflows associated with the project. In simpler terms, IRR is the rate of return at which the net present value of cash flows from a project is zero.

How to Calculate Internal Rate of Return (IRR)?

To calculate the Internal Rate of Return (IRR) for a given project, you need to know the cash flow for the project. You also need to know the time period for which the cash flow is expected.

The Internal Rate of Return (IRR) can be calculated using the following equation:

For example, if you expect a project to generate cash flows of $100 in the first year, $200 in the second year, and $300 in the third year, the equation would be IRR = 3 x (($300/$100) - 1) which would give an IRR of approximately 27%.

Modified Internal Rate of Return (MIRR) Explained

The Modified Internal Rate of Return (MIRR) is a financial metric used to evaluate an investment's profitability. It is calculated by taking the net present value of all cash flows and dividing it by the initial investment.

The MIRR is usually preferred over the Internal Rate of Return (IRR) because it is less sensitive to outliers. The IRR can be adversely affected by large cash flows early in the investment period. The MIRR considers these large cash flows by discounting them at the borrowing rate.

The MIRR can also be used to compare different investments. The higher the MIRR, the more profitable the investment.

Conclusion

The internal rate of return (IRR) is crucial for evaluating potential investments. The rate of return makes the net present value of all cash flows from a particular investment equal to zero, making the tool for comparing different possible investments.